- By Payload Type (Scientific Payload, Communication Payload, Navigation Payload, Observation Payload and Others)

- By Type of Satellite (CubeSats, Small Satellites, Medium Satellites and Large Satellites)

- By Application (Communication, Surveillance, Remote Sensing, and Others)

- By Remote Sensing (Earth Observation and Space & Planetary Science)

- By Orbit (LEO, GEO and Others)

SATELLITE PAYLOAD MARKET REPORT CUSTOMIZATION Request Sample PDF for Undisclosed Values

| Additional Qualitative Customization |

|

|---|---|

| Additional Scope Customization |

|

| Cross Segment Customization |

|

| Additional Country Level Analysis |

|

REPORT OVERVIEW

The satellite payload market report provides a comprehensive analysis of current trends, future growth prospects, and the competitive dynamics within the industry. It includes detailed market forecasts, insights into supply chain dynamics, and technological advancements such as miniaturized payloads and advanced communication systems. The report highlights key industry developments, strategic approaches for market expansion, merger and acquisition opportunities, and regional growth drivers fueled by the increasing demand for satellite-based communication, navigation, and Earth observation. It offers actionable insights for stakeholders to capitalize on emerging opportunities and succeed in this evolving market.

Satellite payload refers to the different payloads required for operations of a spacecraft such as communication payload, navigation payload, observation payload, satellite control systems and so on. Sub systems of these different payloads vary accordingly. For example, communication payload consists of instruments such as modems, radio antennas and transponders to name a few. Similarly, navigation payloads include instruments and systems utilized for determination of position and orientation of satellites or other objects such as gyroscopes, star trackers, accelerometers and so on.

Implementation of satellite-as-a-service has catalyzed the demand of space-based communications and earth observation services across the globe. This has proliferated the global satellite payload market growth. Moreover, increasing satellite constellation projects led to multifold growth of satellite payload market.

GLOBAL SATELLITE PAYLOAD MARKET TREND

Laser Communication and Software Defined System are Prominent Trends for Global Satellite Payload Market

Recent developments in software define satellite have paved the way for autonomous operations of satellites. A software-defined satellite (SDS) is a system which utilizes advanced software to control and manage different functions and operations of a satellite. Traditional satellites heavily rely on fixed and hardware systems whereas SDS utilizes software which makes it more flexible, and upgradable.

In July 2021, Eutelsat launched Eutelsat Quantum satellite onboard Ariane 5 with SDS capabilities. Eutelsat Quantum can provide unprecedented reconfiguration capacity. Its beams can be redirected and reshaped to transfer information to people on moving trucks, planes, and cars nearly in real time. Similarly, in September 2023, Thaicom ordered SDS satellite from Airbus which will be delivered in 2027. Such developments catalyze the global medium and large satellite market growth.

Similar developments in laser or optical communications transponders have paved the way for high-speed data transfer. Many satellite operators have integrated laser transponders majorly for satellite-to-satellite data transfer applications. Recently, Starlink v1.5 satellites have also demonstrated the inter satellite data transfer of 42 million GB per day through laser transceivers. Hence, such advantages over conventional systems will proliferate the global satellite payload market growth.

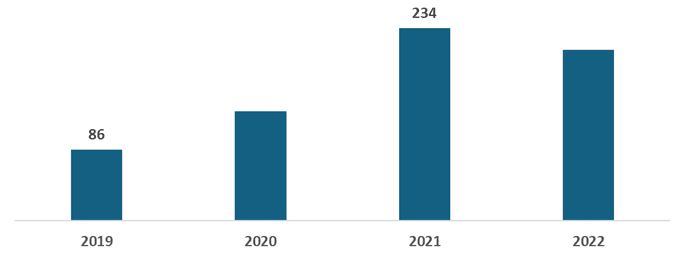

ASIA PACIFIC SATELLITE PAYLOAD MARKET SIZE, 2019-2032 (USD BILLION)

DRIVING FACTORS FOR GLOBAL SATELLITE PAYLOAD MARKET OUTLOOK

Increased Investments in Satellite Constellation Projects Boost the Satellite Payload Market

Satellite constellation missions for navigation, communication and earth observation applications have emerged from private satellite operators for commercial applications. For example, as of March 2024, SpaceX has launched more than 5,500 satellites under Starlink for satellite based broadband services. Starlink provides services to more than 2 million subscribers by the end of year 2023. Such demand for space-based services has garnered significant investment from other players for satellite constellation projects.

Other players such as Amazon, GenMat, Guo Wang, Hanwha Systems, One Web, Xingwang and so on have announced to launch thousands of satellite for various commercial services such as IoT, satellite internet, 6G, earth observation and so on. Also, satellite operators are collaborating with each other to complement their offerings and services. For example, in November 2023, Hanwha Systems announced distribution partnership with OneWeb for high-speed and low latency connectivity across South Korea. Such initiatives catalyze the satellite payload market across the globe.

Number of Small Satellite Launch (Less than 50 kg)

RESTRAINING FACTORS FOR GLOBAL SATELLITE PAYLOAD MARKET ECONOMY

Stringent Regulation and Delay in Approval May Hamper the Satellite Payload Market Growth

Regulatory approvals and policies often lead to significant delays of space missions. For instance, in June 2023, House Armed Services Committee tried to restrict Space Force to procure its 12th communications satellite from Boeing. Moreover, rising concern over space debris also put restrictions on further approval of fleet to satellite operators.

For instance, in March 2019, Russian government has outlined a policy that foreign communication satellite companies must pass data through ground station. This would require setting up of ground station across Russia which lead to significant increase in overall cost. Hence, such regulations may hamper the satellite payload market growth.

SEGMENTATION

- By Payload Type Analysis

Communication Payload Segment Dominated the Market Owing to Launch of Communication Satellite Constellation

By payload type, the market is bifurcated into scientific payload, communication payload, navigation payload, observation payload and others. The communication segment dominated the market owing to integration and launch of thousands of communication satellites in recent years. Major fleet operators such as SpaceX, OneWeb, Amazon and so on have planned to launch satellite constellations in upcoming years for communications services. Such developments propel the communication satellite payload market globally.

- By Type of Satellite Analysis

Medium Satellite Segment Dominated the Satellite Payload Market owing to Higher Demand from Commercial and Military Users

By type of satellite, the satellite payload market is segmented as CubeSats, small satellites, medium satellites, and large satellites. Medium satellite segment dominated the market owing to launch of multiple commercial and military satellites for communication, navigation, and earth observation applications.

- By Application Analysis

Remote Sensing Segment Dominated the Market Owing to Launch of Major Earth and Space Observation Satellites

By application, the satellite payload market is bifurcated into communication, surveillance, remote sensing, and others. The remote sensing segment dominated the market owing to major investments in earth and space observation satellites. Remote sensing payloads are utilized to collect imagery and other relevant data about surface or environment through instruments such as cameras, lidar and radar to name a few for scientific research.

Global Satellite Payload Market Share, By Application – 2023

- By Orbit Analysis

LEO Segment Dominated the Market Owing to Launch of Satellite Constellation Missions across LEO

By orbit, the satellite payload market is bifurcated into LEO, GEO and others. LEO segment holds the highest share in satellite payload market owing to multiple launch of satellite constellations like Starlink, OneWeb and so on. Till February 2024, Starlink alone has launched more than 5,200 satellites in LEO. Such demand propels the growth of satellite payload market across LEO.

REGIONAL INSIGHTS

Geographically, the satellite payload market is bifurcated into Asia Pacific, North America, Europe, Latin America and Middle East & Africa.

The North America satellite payload market holds a significant share and will grow notably owing to increased investments in satellite constellation projects. For instance, under Kuiper initiative, Amazon has planned to launch nearly 3200 satellites in LEO. Such developments catalyze the market growth of satellite payloads across the region.

Europe satellite payload market is estimated to grow notably owing to presence of satellite manufacturers and operators across the region. OneWeb is a major emerging players from U.K. for satellite communications services. Through Ku-band satellite network, OneWeb has also planned to provide inflight connectivity services from September 2024.

The Asia Pacific satellite payload market is estimated to be fastest growing owing rising investments from public and private organizations across the region. Moreover, recent space policy transformation across the region also proliferated the satellite payload market demand from private and public entities. For instance, in November 2022, Japanese government has announced to launch 50 satellites with counterattack capabilities for defense applications, by the end of year 2024. Such developments proliferate the satellite payload market growth across the region.

Middle East & Africa and Latin America satellite payload market is estimated to grow notably owing to rising investments in space and satellite payloads. For example, in April 2023, KAUST successfully launched a CubeSat on Transporter-7 mission of SpaceX. CubeSat can collect high resolution terrestrial, coastal and ocean data globally. Such investments from such satellite operators propel the market growth across the region.

KEY INDUSTRY PLAYERS

Key Players are Focusing on Advanced Satellite Technologies, Acquisition and Collaboration to Increase the Global Market Share

The global satellite payload market is relatively fragmented in nature with presence of key players, such as Airbus, Sierra Nevada Corporation, L3 Harris, Lockheed Martin, Northrop Grumman, SpaceX, and so on. These players are focusing on technological advancements and collaboration to increase their satellite payload market share across the globe.

LIST OF KEY MARKET PLAYERS

- Airbus Defense and Space (Germany)

- Boeing (U.S.)

- China Aerospace Science and Technology Corporation (China)

- Honeywell International Inc. (U.S.)

- JSC Information Satellite Systems (Russia)

- L3 Harris Technologies (U.S.)

- Lockheed Martin (U.S.)

- Maxar Technologies (U.S.)

- Northrop Grumman Corporation (U.S.)

- Raytheon Technologies (U.S.)

- Sierra Nevada Corporation (U.S.)

- SpaceX (U.S.)

- Thales (France)

KEY INDUSTRY DEVELOPMENTS:

In February 2024, SpaceX launched 23 Starlink satellites on board Falcon 9 rocket from Florida. Under Starlink, SpaceX has planned to launch 42,000 satellites in LEO.

In August 2023, MDA acquired digital payload division of SatixFy at USD 40 million. The procurement also consists of a USD 20 million purchase of next-gen digital satellite chipset which brings full deal price at USD 60 million.

In March 2023, OneWeb launched 36 satellites onboard LVM 3 launch vehicle of Indian Space Research Organization. This successful launch led to total 618 constellation of OneWeb.

SATELLITE PAYLOAD MARKET REPORT SCOPE & SEGMENTATION

| Study Period | 2019-2032 |

|---|---|

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Period | 2019-2022 |

| Growth Rate | CAGR of 4.9% from 2024 to 2032 |

| Unit | Value (USD Billion) |

| Market Segmentation | By Payload Type

|

By Type of Satellite

| |

By Orbit

| |

By Application

| |

| By Geography |

|

Frequently Asked Questions

The market is likely to grow at a CAGR of 4.9% over the forecast period (2024-2032).

Remote Sensing is the dominating segment in the Global Satellite Payload Market.

The market size of Asia Pacific satellite payload stood at USD 8.04 billion in 2023.

Increased Investments in Satellite Constellation Missions Boost the Satellite Payload Market

Some of the top players in the market are SpaceX, Airbus, Boeing, Lockheed Martin and so on.

1. Introduction

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Market Trends

4. Key Insights

4.1. Market Penetration Strategies – Merger & Acquisition, Partnership & Collaboration, R&D Investment and Others

4.2. Regulatory Landscape

4.3. Supply Chain Analysis

4.4. Latest Technological Advancements

4.5. Qualitative Insights – Impact of COVID-19 Pandemic on Global Satellite Payload Market

5. Global Satellite Payload Market Analysis, Insights and Forecast, 2019-2032

5.1 Key Findings / Definition

5.2. Market Analysis, Insights and Forecast – By Payload Type

5.2.1. Scientific Payload

5.2.2. Communication Payload

5.2.3. Navigation Payload

5.2.4. Observation Payload

5.2.5. Others

5.3. Market Analysis, Insights and Forecast – By Type of Satellite

5.3.1. CubeSats

5.3.2. Small Satellites

5.3.3. Medium Satellites

5.3.4. Large Satellites

5.4. Market Analysis, Insights and Forecast – By Application

5.4.1. Communication

5.4.2. Surveillance

5.4.3. Remote Sensing

5.4.4. Others

5.5. Market Analysis, Insights and Forecast – By Remote Sensing

5.5.1. Earth Observation

5.5.2. Space & Planetary Science

5.6. Market Analysis, Insights and Forecast – By Orbit

5.6.1. LEO

5.6.2. GEO

5.6.3. Others

5.7. Market Analysis, Insights and Forecast – By Region

5.7.1. North America

5.7.2. Europe

5.7.3. Asia Pacific

5.7.4. Middle East and Africa

5.7.5. Latin America

6. North America Satellite Payload Market Analysis, Insights and Forecast, 2019-2032

6.1. Market Analysis, Insights and Forecast – By Payload Type

6.1.1. Scientific Payload

6.1.2. Communication Payload

6.1.3. Navigation Payload

6.1.4. Observation Payload

6.1.5. Others

6.2. Market Analysis, Insights and Forecast – By Type of Satellite

6.2.1. CubeSats

6.2.2. Small Satellites

6.2.3. Medium Satellites

6.2.4. Large Satellites

6.3. Market Analysis, Insights and Forecast – By Application

6.3.1. Communication

6.3.2. Surveillance

6.3.3. Remote Sensing

6.3.4. Others

6.4. Market Analysis, Insights and Forecast – By Remote Sensing

6.4.1. Earth Observation

6.4.2. Space & Planetary Science

6.5. Market Analysis, Insights and Forecast – By Orbit

6.5.1. LEO

6.5.2. GEO

6.5.3. Others

6.6. Market Analysis, Insights and Forecast – By Country

6.6.1. U.S.

6.6.1.1. Market Analysis, Insights and Forecast – By Type of Satellite

6.6.1.1.1. CubeSats

6.6.1.1.2. Small Satellites

6.6.1.1.3. Medium Satellites

6.6.1.1.4. Large Satellites

6.6.2. Canada

6.6.2.1. Market Analysis, Insights and Forecast – By Type of Satellite

6.6.2.1.1. CubeSats

6.6.2.1.2. Small Satellites

6.6.2.1.3. Medium Satellites

6.6.2.1.4. Large Satellites

7. Europe Satellite Payload Market Analysis, Insights and Forecast, 2019-2032

7.1. Market Analysis, Insights and Forecast – By Payload Type

7.1.1. Scientific Payload

7.1.2. Communication Payload

7.1.3. Navigation Payload

7.1.4. Observation Payload

7.1.5. Others

7.2. Market Analysis, Insights and Forecast – By Type of Satellite

7.2.1. CubeSats

7.2.2. Small Satellites

7.2.3. Medium Satellites

7.2.4. Large Satellites

7.3. Market Analysis, Insights and Forecast – By Application

7.3.1. Communication

7.3.2. Surveillance

7.3.3. Remote Sensing

7.3.4. Others

7.4. Market Analysis, Insights and Forecast – By Remote Sensing

7.4.1. Earth Observation

7.4.2. Space & Planetary Science

7.5. Market Analysis, Insights and Forecast – By Orbit

7.5.1. LEO

7.5.2. GEO

7.5.3. Others

7.6. Market Analysis, Insights and Forecast – By Country

7.6.1. U.K.

7.6.1.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.1.1.1. CubeSats

7.6.1.1.2. Small Satellites

7.6.1.1.3. Medium Satellites

7.6.1.1.4. Large Satellites

7.6.2. Germany

7.6.2.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.2.1.1. CubeSats

7.6.2.1.2. Small Satellites

7.6.2.1.3. Medium Satellites

7.6.2.1.4. Large Satellites

7.6.3. France

7.6.3.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.3.1.1. CubeSats

7.6.3.1.2. Small Satellites

7.6.3.1.3. Medium Satellites

7.6.3.1.4. Large Satellites

7.6.4. Luxembourg

7.6.4.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.4.1.1. CubeSats

7.6.4.1.2. Small Satellites

7.6.4.1.3. Medium Satellites

7.6.4.1.4. Large Satellites

7.6.5. Russia

7.6.5.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.5.1.1. CubeSats

7.6.5.1.2. Small Satellites

7.6.5.1.3. Medium Satellites

7.6.5.1.4. Large Satellites

7.6.6. Nordic Countries

7.6.6.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.6.1.1. CubeSats

7.6.6.1.2. Small Satellites

7.6.6.1.3. Medium Satellites

7.6.6.1.4. Large Satellites

7.6.7. Rest of Europe

7.6.7.1. Market Analysis, Insights and Forecast – By Type of Satellite

7.6.7.1.1. CubeSats

7.6.7.1.2. Small Satellites

7.6.7.1.3. Medium Satellites

7.6.7.1.4. Large Satellites

8. Asia Pacific Satellite Payload Market Analysis, Insights and Forecast, 2019-2032

8.1. Market Analysis, Insights and Forecast – By Payload Type

8.1.1. Scientific Payload

8.1.2. Communication Payload

8.1.3. Navigation Payload

8.1.4. Observation Payload

8.1.5. Others

8.2. Market Analysis, Insights and Forecast – By Type of Satellite

8.2.1. CubeSats

8.2.2. Small Satellites

8.2.3. Medium Satellites

8.2.4. Large Satellites

8.3. Market Analysis, Insights and Forecast – By Application

8.3.1. Communication

8.3.2. Surveillance

8.3.3. Remote Sensing

8.3.4. Others

8.4. Market Analysis, Insights and Forecast – By Remote Sensing

8.4.1. Earth Observation

8.4.2. Space & Planetary Science

8.5. Market Analysis, Insights and Forecast – By Orbit

8.5.1. LEO

8.5.2. GEO

8.5.3. Others

8.6. Market Analysis, Insights and Forecast – By Country

8.6.1. China

8.6.1.1. Market Analysis, Insights and Forecast – By Type of Satellite

8.6.1.1.1. CubeSats

8.6.1.1.2. Small Satellites

8.6.1.1.3. Medium Satellites

8.6.1.1.4. Large Satellites

8.6.2. India

8.6.2.1. Market Analysis, Insights and Forecast – By Type of Satellite

8.6.2.1.1. CubeSats

8.6.2.1.2. Small Satellites

8.6.2.1.3. Medium Satellites

8.6.2.1.4. Large Satellites

8.6.3. Japan

8.6.3.1. Market Analysis, Insights and Forecast – By Type of Satellite

8.6.3.1.1. CubeSats

8.6.3.1.2. Small Satellites

8.6.3.1.3. Medium Satellites

8.6.3.1.4. Large Satellites

8.6.4. South Korea

8.6.4.1. Market Analysis, Insights and Forecast – By Type of Satellite

8.6.4.1.1. CubeSats

8.6.4.1.2. Small Satellites

8.6.4.1.3. Medium Satellites

8.6.4.1.4. Large Satellites

8.6.5. Southeast Asia

8.6.5.1. Market Analysis, Insights and Forecast – By Type of Satellite

8.6.5.1.1. CubeSats

8.6.5.1.2. Small Satellites

8.6.5.1.3. Medium Satellites

8.6.5.1.4. Large Satellites

8.6.6. Rest of Asia Pacific

8.6.6.1. Market Analysis, Insights and Forecast – By Type of Satellite

8.6.6.1.1. CubeSats

8.6.6.1.2. Small Satellites

8.6.6.1.3. Medium Satellites

8.6.6.1.4. Large Satellites

9. Middle East and Africa Satellite Payload Market Analysis, Insights and Forecast, 2019-2032

9.1. Market Analysis, Insights and Forecast – By Payload Type

9.1.1. Scientific Payload

9.1.2. Communication Payload

9.1.3. Navigation Payload

9.1.4. Observation Payload

9.1.5. Others

9.2. Market Analysis, Insights and Forecast – By Type of Satellite

9.2.1. CubeSats

9.2.2. Small Satellites

9.2.3. Medium Satellites

9.2.4. Large Satellites

9.3. Market Analysis, Insights and Forecast – By Application

9.3.1. Communication

9.3.2. Surveillance

9.3.3. Remote Sensing

9.3.4. Others

9.4. Market Analysis, Insights and Forecast – By Remote Sensing

9.4.1. Earth Observation

9.4.2. Space & Planetary Science

9.5. Market Analysis, Insights and Forecast – By Orbit

9.5.1. LEO

9.5.2. GEO

9.5.3. Others

9.6. Market Analysis, Insights and Forecast – By Country

9.6.1. UAE

9.6.1.1. Market Analysis, Insights and Forecast – By Type of Satellite

9.6.1.1.1. CubeSats

9.6.1.1.2. Small Satellites

9.6.1.1.3. Medium Satellites

9.6.1.1.4. Large Satellites

9.6.2. Israel

9.6.2.1. Market Analysis, Insights and Forecast – By Type of Satellite

9.6.2.1.1. CubeSats

9.6.2.1.2. Small Satellites

9.6.2.1.3. Medium Satellites

9.6.2.1.4. Large Satellites

9.6.3. Turkey

9.6.3.1. Market Analysis, Insights and Forecast – By Type of Satellite

9.6.3.1.1. CubeSats

9.6.3.1.2. Small Satellites

9.6.3.1.3. Medium Satellites

9.6.3.1.4. Large Satellites

9.6.4. Rest of Middle East and Africa

9.6.4.1. Market Analysis, Insights and Forecast – By Type of Satellite

9.6.4.1.1. CubeSats

9.6.4.1.2. Small Satellites

9.6.4.1.3. Medium Satellites

9.6.4.1.4. Large Satellites

10. Latin America Satellite Payload Market Analysis, Insights and Forecast, 2019-2032

10.1. Market Analysis, Insights and Forecast – By Payload Type

10.1.1. Scientific Payload

10.1.2. Communication Payload

10.1.3. Navigation Payload

10.1.4. Observation Payload

10.1.5. Others

10.2. Market Analysis, Insights and Forecast – By Type of Satellite

10.2.1. CubeSats

10.2.2. Small Satellites

10.2.3. Medium Satellites

10.2.4. Large Satellites

10.3. Market Analysis, Insights and Forecast – By Application

10.3.1. Communication

10.3.2. Surveillance

10.3.3. Remote Sensing

10.3.4. Others

10.4. Market Analysis, Insights and Forecast – By Remote Sensing

10.4.1. Earth Observation

10.4.2. Space & Planetary Science

10.5. Market Analysis, Insights and Forecast – By Orbit

10.5.1. LEO

10.5.2. GEO

10.5.3. Others

10.6. Market Analysis, Insights and Forecast – By Country

10.6.1. Brazil

10.6.1.1. Market Analysis, Insights and Forecast – By Type of Satellite

10.6.1.1.1. CubeSats

10.6.1.1.2. Small Satellites

10.6.1.1.3. Medium Satellites

10.6.1.1.4. Large Satellites

10.6.2. Argentina

10.6.2.1. Market Analysis, Insights and Forecast – By Type of Satellite

10.6.2.1.1. CubeSats

10.6.2.1.2. Small Satellites

10.6.2.1.3. Medium Satellites

10.6.2.1.4. Large Satellites

10.6.3. Rest of Latin America

10.6.3.1. Market Analysis, Insights and Forecast – By Type of Satellite

10.6.3.1.1. CubeSats

10.6.3.1.2. Small Satellites

10.6.3.1.3. Medium Satellites

10.6.3.1.4. Large Satellites

11. Competitive Analysis

11.1. Global Market Rank Analysis (2023)

11.2. Competitive Dashboard

12. Company Profiles (Overview, Products & Services, Financials (Based on Availability), Recent Developments, Strategies, SWOT Analysis)

12.1. Airbus Defense and Space (Germany)

12.2. JSC Information Satellite Systems (Russia)

12.3. L3 Harris Technologies (U.S.)

12.4. Lockheed Martin (U.S.)

12.5. Northrop Grumman Corporation (U.S.)

12.6. Raytheon Technologies (U.S.)

12.7. Boeing (U.S.)

12.8. Thales (France)

12.9. China Aerospace Science and Technology Corporation (China)

12.10. Maxar Technologies (U.S.)

12.11. SpaceX (U.S.)

12.12. Sierra Nevada Corporation (U.S.)

12.13. Honeywell International Inc. (U.S.)

Table 1: Global Satellite Payload Market, (USD Billion) Forecast, By Payload Type, 2019-2032

Table 2: Global Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 3: Global Satellite Payload Market, (USD Billion) Forecast, By Application, 2019-2032

Table 4: Global Satellite Payload Market, (USD Billion) Forecast, By Remote Sensing, 2019-2032

Table 5: Global Satellite Payload Market, (USD Billion) Forecast, By Orbit, 2019-2032

Table 6: Global Satellite Payload Market (USD Billion) Forecast, By Region, 2019-2032

Table 7: North America Satellite Payload Market, (USD Billion) Forecast, By Payload Type, 2019-2032

Table 8: North America Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 9: North America Satellite Payload Market, (USD Billion) Forecast, By Application, 2019-2032

Table 10: North America Satellite Payload Market, (USD Billion) Forecast, By Remote Sensing, 2019-2032

Table 11: North America Satellite Payload Market, (USD Billion) Forecast, By Orbit, 2019-2032

Table 12: North America Satellite Payload Market (USD Billion) Forecast, By Country, 2019-2032

Table 13: U.S. Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 14: Canada Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 15: Europe Satellite Payload Market, (USD Billion) Forecast, By Payload Type, 2019-2032

Table 16: Europe Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 17: Europe Satellite Payload Market, (USD Billion) Forecast, By Application, 2019-2032

Table 18: Europe Satellite Payload Market, (USD Billion) Forecast, By Remote Sensing, 2019-2032

Table 19: Europe Satellite Payload Market, (USD Billion) Forecast, By Orbit, 2019-2032

Table 20: Europe Satellite Payload Market (USD Billion) Forecast, By Country, 2019-2032

Table 21: UK Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 22: Germany Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 23: France Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 24: Luxembourg Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 25: Russia Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 26: Nordic Countries Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 27: Rest of Europe Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 28: Asia Pacific Satellite Payload Market, (USD Billion) Forecast, By Payload Type, 2019-2032

Table 29: Asia Pacific Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 30: Asia Pacific Satellite Payload Market, (USD Billion) Forecast, By Application, 2019-2032

Table 31: Asia Pacific Satellite Payload Market, (USD Billion) Forecast, By Remote Sensing, 2019-2032

Table 32: Asia Pacific Satellite Payload Market, (USD Billion) Forecast, By Orbit, 2019-2032

Table 33: Asia Pacific Satellite Payload Market (USD Billion) Forecast, By Country, 2019-2032

Table 34: China Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 35: India Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 36: Japan Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 37: South Korea Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 38: Southeast Asia Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 39: Rest of Asia Pacific Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 40: Middle East and Africa Satellite Payload Market, (USD Billion) Forecast, By Payload Type, 2019-2032

Table 41: Middle East and Africa Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 42: Middle East and Africa Satellite Payload Market, (USD Billion) Forecast, By Application, 2019-2032

Table 43: Middle East and Africa Satellite Payload Market, (USD Billion) Forecast, By Remote Sensing, 2019-2032

Table 44: Middle East and Africa Satellite Payload Market, (USD Billion) Forecast, By Orbit, 2019-2032

Table 45: Middle East and Africa Satellite Payload Market (USD Billion) Forecast, By Country, 2019-2032

Table 46: UAE Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 47: Israel Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 48: Turkey Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 49: Rest of Middle East and Africa Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 50: Latin America Satellite Payload Market, (USD Billion) Forecast, By Payload Type, 2019-2032

Table 51: Latin America Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 52: Latin America Satellite Payload Market, (USD Billion) Forecast, By Application, 2019-2032

Table 53: Latin America Satellite Payload Market, (USD Billion) Forecast, By Remote Sensing, 2019-2032

Table 54: Latin America Satellite Payload Market, (USD Billion) Forecast, By Orbit, 2019-2032

Table 55: Latin America Satellite Payload Market (USD Billion) Forecast, By Country, 2019-2032

Table 56: Brazil Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 57: Argentina Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Table 58: Rest of Latin America Satellite Payload Market, (USD Billion) Forecast, By Type of Satellite, 2019-2032

Figure 1: Global Satellite Payload Market Revenue Breakdown (USD Billion, %) By Region, 2024 & 2032

Figure 2: Global Satellite Payload Market (%) Breakdown By Payload Type, 2023 & 2032

Figure 3: Global Satellite Payload Market (USD Billion) Breakdown By Scientific Payload, 2019-2032

Figure 4: Global Satellite Payload Market (USD Billion) Breakdown By Communication Payload, 2019-2032

Figure 5: Global Satellite Payload Market (USD Billion) Breakdown By Navigation Payload, 2019-2032

Figure 6: Global Satellite Payload Market (USD Billion) Breakdown By Observation Payload, 2019-2032

Figure 7: Global Satellite Payload Market (USD Billion) Breakdown By Others, 2019-2032

Figure 8: Global Satellite Payload Market (%) Breakdown By Type of Satellite, 2023 & 2032

Figure 9: Global Satellite Payload Market (USD Billion) Breakdown By CubeSats, 2019-2032

Figure 10: Global Satellite Payload Market (USD Billion) Breakdown By Small Satellites, 2019-2032

Figure 11: Global Satellite Payload Market (USD Billion) Breakdown By Medium Satellites, 2019-2032

Figure 12: Global Satellite Payload Market (USD Billion) Breakdown By Large Satellites, 2019-2032

Figure 13: Global Satellite Payload Market (%) Breakdown By Application, 2023 & 2032

Figure 14: Global Satellite Payload Market (USD Billion) Breakdown By Communication, 2019-2032

Figure 15: Global Satellite Payload Market (USD Billion) Breakdown By Surveillance, 2019-2032

Figure 16: Global Satellite Payload Market (USD Billion) Breakdown By Remote Sensing, 2019-2032

Figure 17: Global Satellite Payload Market (USD Billion) Breakdown By Others, 2019-2032

Figure 18: Global Satellite Payload Market (%) Breakdown By Remote Sensing, 2023 & 2032

Figure 19: Global Satellite Payload Market (USD Billion) Breakdown By Earth Observation, 2019-2032

Figure 20: Global Satellite Payload Market (USD Billion) Breakdown By Space & Planetary Science, 2019-2032

Figure 21: Global Satellite Payload Market (%) Breakdown By Orbit, 2023 & 2032

Figure 22: Global Satellite Payload Market (USD Billion) Breakdown By LEO, 2019-2032

Figure 23: Global Satellite Payload Market (USD Billion) Breakdown By GEO, 2019-2032

Figure 24: Global Satellite Payload Market (USD Billion) Breakdown By Others, 2019-2032

Figure 25: Global Satellite Payload Market Share (%) By Region, 2023 & 2032

Figure 26: North America Satellite Payload Market Value (USD Billion) By Payload Type, 2023 & 2032

Figure 27: North America Satellite Payload Market Value Share (%) By Payload Type, 2023

Figure 28: North America Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 29: North America Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 30: North America Satellite Payload Market Value (USD Billion) By Application, 2023 & 2032

Figure 31: North America Satellite Payload Market Value Share (%) By Application, 2023

Figure 32: North America Satellite Payload Market Value (USD Billion) By Remote Sensing, 2023 & 2032

Figure 33: North America Satellite Payload Market Value Share (%) By Remote Sensing, 2023

Figure 34: North America Satellite Payload Market Value (USD Billion) By Orbit, 2023 & 2032

Figure 35: North America Satellite Payload Market Value Share (%) By Orbit, 2023

Figure 36: North America Satellite Payload Market Value (USD Billion) By Country, 2023 & 2032

Figure 37: North America Satellite Payload Value Share (%) By Country, 2023

Figure 38: U.S. Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 39: U.S. Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 40: Canada Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 41: Canada Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 42: Europe Satellite Payload Market Value (USD Billion) By Payload Type, 2023 & 2032

Figure 43: Europe Satellite Payload Market Value Share (%) By Payload Type, 2023

Figure 44: Europe Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 45: Europe Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 46: Europe Satellite Payload Market Value (USD Billion) By Application, 2023 & 2032

Figure 47: Europe Satellite Payload Market Value Share (%) By Application, 2023

Figure 48: Europe Satellite Payload Market Value (USD Billion) By Remote Sensing, 2023 & 2032

Figure 49: Europe Satellite Payload Market Value Share (%) By Remote Sensing, 2023

Figure 50: Europe Satellite Payload Market Value (USD Billion) By Orbit, 2023 & 2032

Figure 51: Europe Satellite Payload Market Value Share (%) By Orbit, 2023

Figure 52: Europe Satellite Payload Market Value (USD Billion) By Country, 2023 & 2032

Figure 53: Europe Satellite Payload Value Share (%) By Country, 2023

Figure 54: UK Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 55: UK Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 56: Germany Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 57: Germany Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 58: France Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 59: France Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 60: Luxembourg Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 61: Luxembourg Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 62: Russia Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 63: Russia Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 64: Nordic Countries Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 65: Nordic Countries Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 66: Rest of Europe Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 67: Rest of Europe Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 68: Asia Pacific Satellite Payload Market Value (USD Billion) By Payload Type, 2023 & 2032

Figure 69: Asia Pacific Satellite Payload Market Value Share (%) By Payload Type, 2023

Figure 70: Asia Pacific Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 71: Asia Pacific Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 72: Asia Pacific Satellite Payload Market Value (USD Billion) By Application, 2023 & 2032

Figure 73: Asia Pacific Satellite Payload Market Value Share (%) By Application, 2023

Figure 74: Asia Pacific Satellite Payload Market Value (USD Billion) By Remote Sensing, 2023 & 2032

Figure 75: Asia Pacific Satellite Payload Market Value Share (%) By Remote Sensing, 2023

Figure 76: Asia Pacific Satellite Payload Market Value (USD Billion) By Orbit, 2023 & 2032

Figure 77: Asia Pacific Satellite Payload Market Value Share (%) By Orbit, 2023

Figure 78: Asia Pacific Satellite Payload Market Value (USD Billion) By Country, 2023 & 2032

Figure 79: Asia Pacific Satellite Payload Value Share (%) By Country, 2023

Figure 80: China Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 81: China Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 82: India Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 83: India Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 84: Japan Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 85: Japan Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 86: South Korea Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 87: South Korea Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 88: Southeast Asia Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 89: Southeast Asia Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 90: Rest of Asia Pacific Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 91: Rest of Asia Pacific Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 92: Middle East and Africa Satellite Payload Market Value (USD Billion) By Payload Type, 2023 & 2032

Figure 93: Middle East and Africa Satellite Payload Market Value Share (%) By Payload Type, 2023

Figure 94: Middle East and Africa Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 95: Middle East and Africa Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 96: Middle East and Africa Satellite Payload Market Value (USD Billion) By Application, 2023 & 2032

Figure 97: Middle East and Africa Satellite Payload Market Value Share (%) By Application, 2023

Figure 98: Middle East and Africa Satellite Payload Market Value (USD Billion) By Remote Sensing, 2023 & 2032

Figure 99: Middle East and Africa Satellite Payload Market Value Share (%) By Remote Sensing, 2023

Figure 100: Middle East and Africa Satellite Payload Market Value (USD Billion) By Orbit, 2023 & 2032

Figure 101: Middle East and Africa Satellite Payload Market Value Share (%) By Orbit, 2023

Figure 102: Middle East and Africa Satellite Payload Market Value (USD Billion) By Country, 2023 & 2032

Figure 103: Middle East and Africa Satellite Payload Value Share (%) By Country, 2023

Figure 104: UAE Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 105: UAE Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 106: Israel Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 107: Israel Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 108: Turkey Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 109: Turkey Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 110: Rest of Middle East and Africa Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 111: Rest of Middle East and Africa Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 112: Latin America Satellite Payload Market Value (USD Billion) By Payload Type, 2023 & 2032

Figure 113: Latin America Satellite Payload Market Value Share (%) By Payload Type, 2023

Figure 114: Latin America Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 115: Latin America Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 116: Latin America Satellite Payload Market Value (USD Billion) By Application, 2023 & 2032

Figure 117: Latin America Satellite Payload Market Value Share (%) By Application, 2023

Figure 118: Latin America Satellite Payload Market Value (USD Billion) By Remote Sensing, 2023 & 2032

Figure 119: Latin America Satellite Payload Market Value Share (%) By Remote Sensing, 2023

Figure 120: Latin America Satellite Payload Market Value (USD Billion) By Orbit, 2023 & 2032

Figure 121: Latin America Satellite Payload Market Value Share (%) By Orbit, 2023

Figure 122: Latin America Satellite Payload Market Value (USD Billion) By Country, 2023 & 2032

Figure 123: Latin America Satellite Payload Value Share (%) By Country, 2023

Figure 124: Brazil Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 125: Brazil Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 126: Argentina Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 127: Argentina Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 128: Rest of Latin America Satellite Payload Market Value (USD Billion) By Type of Satellite, 2023 & 2032

Figure 129: Rest of Latin America Satellite Payload Market Value Share (%) By Type of Satellite, 2023

Figure 130: Global Satellite Payload Market Rank Analysis, By Key Players, 2023

SATELLITE PAYLOAD MARKET REPORT SCOPE & SEGMENTATION

| Study Period | 2019-2032 |

|---|---|

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Period | 2019-2022 |

| Growth Rate | CAGR of 4.9% from 2024 to 2032 |

| Unit | Value (USD Billion) |

| Market Segmentation | By Payload Type

|

By Type of Satellite

| |

By Orbit

| |

By Application

| |

| By Geography |

|